MRO purchases in the packaging industry are often made more complicated by strict health and safety rules but that doesn’t mean there aren’t opportunities to make efficiencies

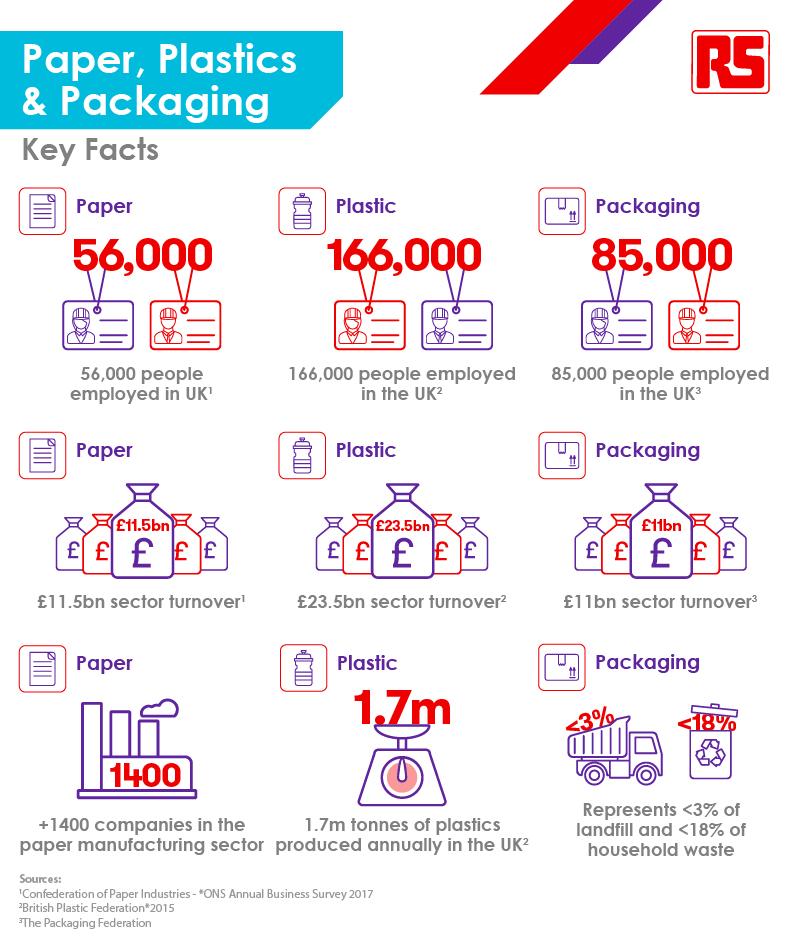

The UK’s packaging, plastics and paper industries have a number of challenges in common when it comes to the indirect procurement cost of industrial supplies for Maintenance, Repair and Operations (MRO). These are industries where there is a lot of competition, margins are often tight and raw material costs vary hugely with currency fluctuations. As such, there is significant pressure on organisations to find efficiencies that will help their bottom line, and MRO is an area where significant savings can be made.

However, according to Craig Stasik, Industry Sector Manager at RS, it is also an area that is often ignored by companies. “MRO is a complex beast and is frequently overlooked as customers spend a disproportionate time on direct spend categories,” he says. “This is understandable due to headline savings they can make on per-unit prices. But in a lot of cases the size of the tail-spend highlights there are ways to improve efficiencies.”

Trusted suppliers

While this strategy is understandable in cost terms, it makes it vital to have a good MRO strategy in place, along with suppliers you can trust so that when machines do break down, it won’t cost your business money. As Helen Alder, the Chartered Institute of Procurement and Supply’s Head of Knowledge, explains: “Organisations don’t always understand what MRO is, and therefore they do not see the need or value in having a strategy in place.

“The most significant reason for getting this right is that among the products you purchase will be items that would cause your operations to grind to a halt if they went wrong and you can’t replace them quickly,” she adds. “Ultimately, the most important thing is to keep your business running so that you don’t have downtime that incurs costs and affects profitability.”

The answer is to work with fewer, trusted suppliers who carry the stock that engineers require and can deliver those products in the time required. For the packaging industry, this is made more complex by the need for a number of specialist parts or specific types of Personal Protective Equipment (PPE). Ensuring legislative compliance requires industry knowledge. “It’s important for companies to work with distributors with a full, traceable supply chain,” says Stasik. “Both the distributors and manufacturers of PPE products – the footwear, gloves, ear defenders or glasses and so on – are accountable, so as a distributor we can only sell products which conform to these regulations.”

Reducing “maverick” spending

This leads to another potential risk area with MRO procurement, both in terms of costs and actual safety – “maverick spending”. “This is a massive risk,” says Alder. “Buying parts from non-approved suppliers may cost more and possibly take longer to source, but the biggest issue is the quality of the parts. It’s not unknown for engineers or other employees to search the internet and buy parts that turn out to be counterfeit, or that don’t meet the required quality levels. Where you have these products going into machines with moving parts, you have potentially very serious consequences if they go wrong.”

The 2019 Indirect Procurement Report, carried out by RS and the Chartered Institute of Procurement and Supply (CIPS), found that close to a quarter (26%) of all businesses saw counterfeit parts as a significant concern.

By working with a small group of approved suppliers, ideally ones that provide an integrated eProcurement system, which makes ordering easier for the end user, it’s possible to dramatically cut maverick spend and streamline the entire MRO process.

"So many manufacturers have stores full of all sorts of different brands and products, which are all classified as working capital"Craig Stasik, Industry Sector Manager, RS

The final area that companies should be reviewing is the amount of MRO stock held on site. “So many manufacturers in this sector have stores full of all sorts of different brands and products,” says Stasik. “Holding this stock is classified as working capital. At RS we can help customers review that stock and in many cases work with them to free up cash.

“And, if a company has stock that is definitely needed on-site, it’s possible to support this through our comprehensive range of managed inventory services. The need to monitor and ensure cash is not tied up in unnecessary inventory such as industrial supplies, can be reduced by regularly reviewing stock, consumption and maintaining minimum and maximum levels.”